The answer is Yes, Yes, and Yes! When deciding to take a sabbatical, my finances were my biggest concern. Like most people, I relied on my paycheck every 2 weeks to support my lifestyle. The idea of the sabbatical is great, but can I afford to stop working? Will I run out of money? As you can tell, there was alot of panic. However, I reminded myself of the goal of a sabbatical and planned to make it happen. Even if it would only be for a few weeks.

How do people afford sabbaticals?

There are many ways that you can fund your sabbatical. All that it requires is great planning. If you were to search Google, you will find a ton of articles on using your retirement fund, 529c, or Roth IRA to fund your sabbatical. These are great options if you have a large amount of money in those accounts but that did not pertain to me.

Secondly, the obvious answer is to use your savings. While I think it is a viable option, I did not want to use all of my savings to fund the sabbatical. I still hear my mom saying “Make sure you always have money for a rainy day. ”If you have a spouse, significant other, or partner, it may be possible to live off of one paycheck.

For me, I had to reflect on my current circumstances. I am single, with no children, a homeowner, and I love to travel. You may be saying, “That’s why you can take a sabbatical.” It might be true, but I also truly believe anyone can do anything. Therefore it was important to me that I could still live my current lifestyle while on sabbatical.

How do I prepare financially for a sabbatical?

To truly prepare for your sabbatical, especially if it is self-funded, you will need to take a deep dive into your finances. The 3 major steps are 1) Review Current Finances 2) Determine Budget for Sabbatical 3) Plan for securing money for the sabbatical.

I would recommend sitting down with yourself, at a quiet time, and going through the numbers. Deep dive into finances

Review the current state of your finances

Look at all your bills and current spending habits including travel, entertainment, and if you have a shopping habit (like I do). If you already use a budget software like quicken or Mint. Great! It will provide you with a snapshot of your current expenses. How are you spending your money?

A part of looking at your finances is reviewing your debt, especially credit card debt. Do you have a high credit card balance? Are you a daily Starbucks drinker? Do you have a shopping habit? Would you limit your spending for a few months, so that you can buy our time? I think you can!

In reviewing my finances, I used an excel spreadsheet to assess my budget. Currently, I use Mint for budgeting and tracking my spending. One of the silver linings of the pandemic for me is that I did not travel. The surplus of cash allowed me to pay off my student loans AND pay off my credit cards. I am happy to say for the past 2 years, I pay off my credit cards every month and it FEELS GOOD!

Determine Budget for Sabbatical.

This step requires a bit of honesty. I love my lifestyle. I enjoy my Peloton, eating delicious food, and travel. It was important to me that my lifestyle did not change on sabbatical. Otherwise, what is the point?

Therefore, I created a spreadsheet that highlighted my cost-of-living expenses including my mortgage, utilities, and necessities like groceries, gas, gym memberships, donations, and nail appointments. Yes, nail appointments, I like doing my nails. Once these numbers were added to the spreadsheet, this was the minimum amount I would spend each month.

Then I added my nice to have such as monthly travel, shopping, entertainment, and restaurants. This number is based on my current habits pre-sabbatical and then adjusted to my sabbatical lifestyle. Now I had the maximum amount I could spend each month. Now I could focus on where I would allocate the money and how many months I could take off.

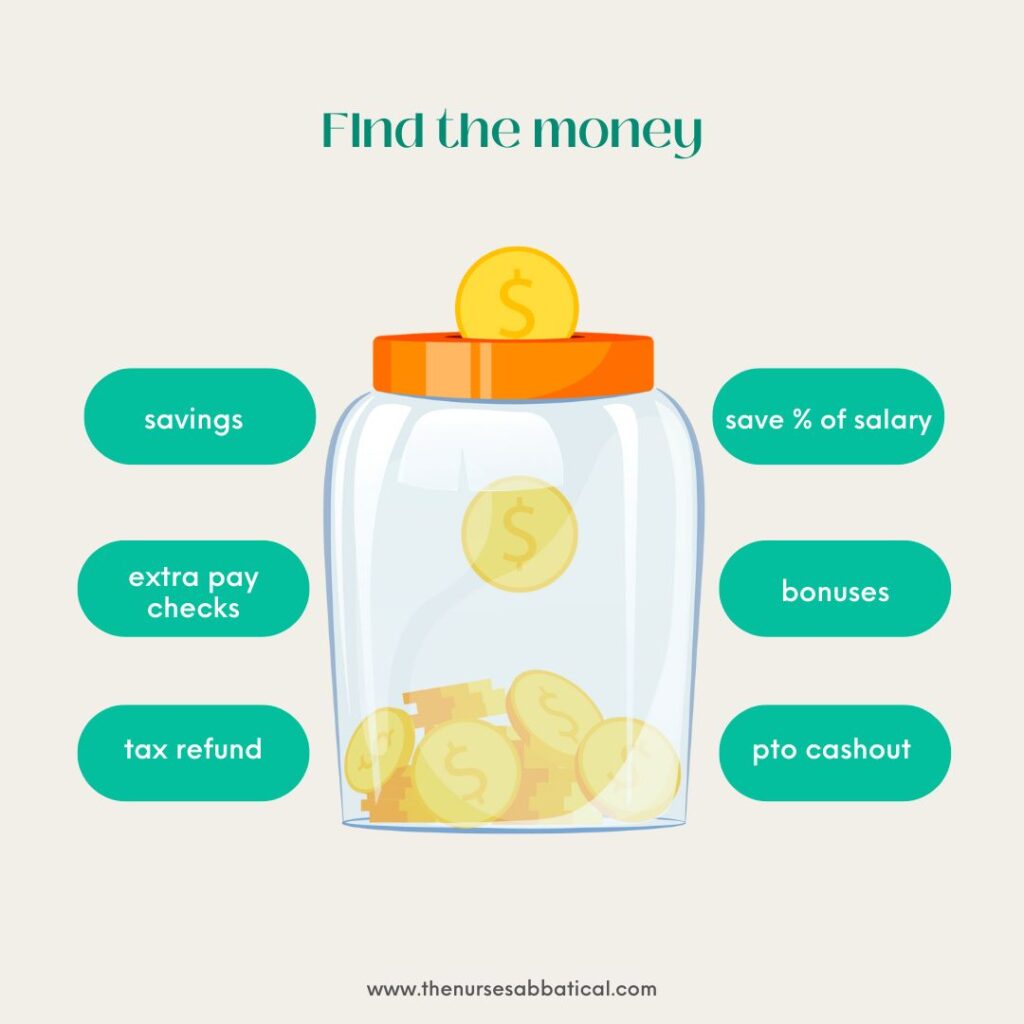

Find the money!

Now it’s time to strategize your funding. Firstly, review your savings. How much of it would you contribute to your sabbatical? Maybe it’s 0. That’s ok, it is a starting point.

Next, determine how much money you would be willing to save from each check to pay for your sabbatical. Or how much money would you be willing to save to buy your time back? That question was more motivating to me.

There are 2 months in each year that you can receive an extra check. This website has a list of the months for the next 5 years. In addition, your vacation time is another source of money. Are you able to cash out in the summer? If you are leaving the job, determine if your vacation time will be paid out. Lastly, do you receive bonuses? If so, then you want to wait for your bonus to be paid out before leaving.

Lastly, depending on the time of year, you can add your tax returns. For an upcoming tax season, you can estimate your refund for the year. Your return may buy you another month of freedom! I used all of these methods to create a surplus of cash so that I could fund my 3-month sabbatical!

What about health insurance?

I will admit it wasn’t high on my priority list until. Prior to leaving my job, I had scheduled all my annual checkups. My GYN doctor reminded me and my mother that I needed to secure insurance. First, you should know that if you work the 1st day of a month, you will have coverage for the entire month. I had 1 month down ad 2 to go.

My options for the next 2 months included COBRA and the Health Insurance Market (Affordable Care Act). COBRA is an extension of your work insurance typically at a high premium. The health insurance marketplace provides insurance premiums at a discount but only has open enrollment from December to January. There is also Medicaid available depending on your financial situation and expected income.

I am healthy and so I wanted basic coverage for health to cover annual exams. Since my sabbatical dates were aligned with open enrollment for the Health Insurance Market, I went with that option. Please note in selecting insurance, you may want to consider your current health, medications, or chronic illnesses. Health insurance is important, but I don’t believe it is the reason to stay at a job.

Is this the right time for a sabbatical?

I think this was probably the most important question. When I was contemplating my sabbatical, I was about 6 months from my 40th birthday and was determined to create a life that I loved and that I did not need a vacation from. (And so far it is!). With these steps, I created a plan and secured the money the support 3 months of my sabbatical. Also known as my Freedom!

You can too! What are you waiting for? Start planning today!