We’ve been conditioned to believe sabbaticals are only for professors, executives, or the wealthy. That unless you quit your job, have six months of savings, or run off to Bali, it doesn’t count.

But here’s the truth: a sabbatical isn’t about burning your life down. It’s about creating intentional space — whatever that looks like for you.

For nurses and mid-career professionals, the idea of “taking time off” can sound impossible. You’ve got bills. Families. Responsibilities. People who depend on you. But I want to show you that a sabbatical doesn’t have to mean blowing up your entire life. It can be as personal, practical, and possible as you decide.

Myth 1: You Have to Quit Your Job Completely

When I took my sabbatical, I did quit my job — and I share that full story in Why I Took a Sabbatical. I was exhausted, unmotivated, and even a Senior Director role couldn’t spark excitement anymore. No title was going to fix the feeling I had. I needed a reset, and leaving was the only path that made sense for me.

But not everyone has to quit to take a sabbatical.

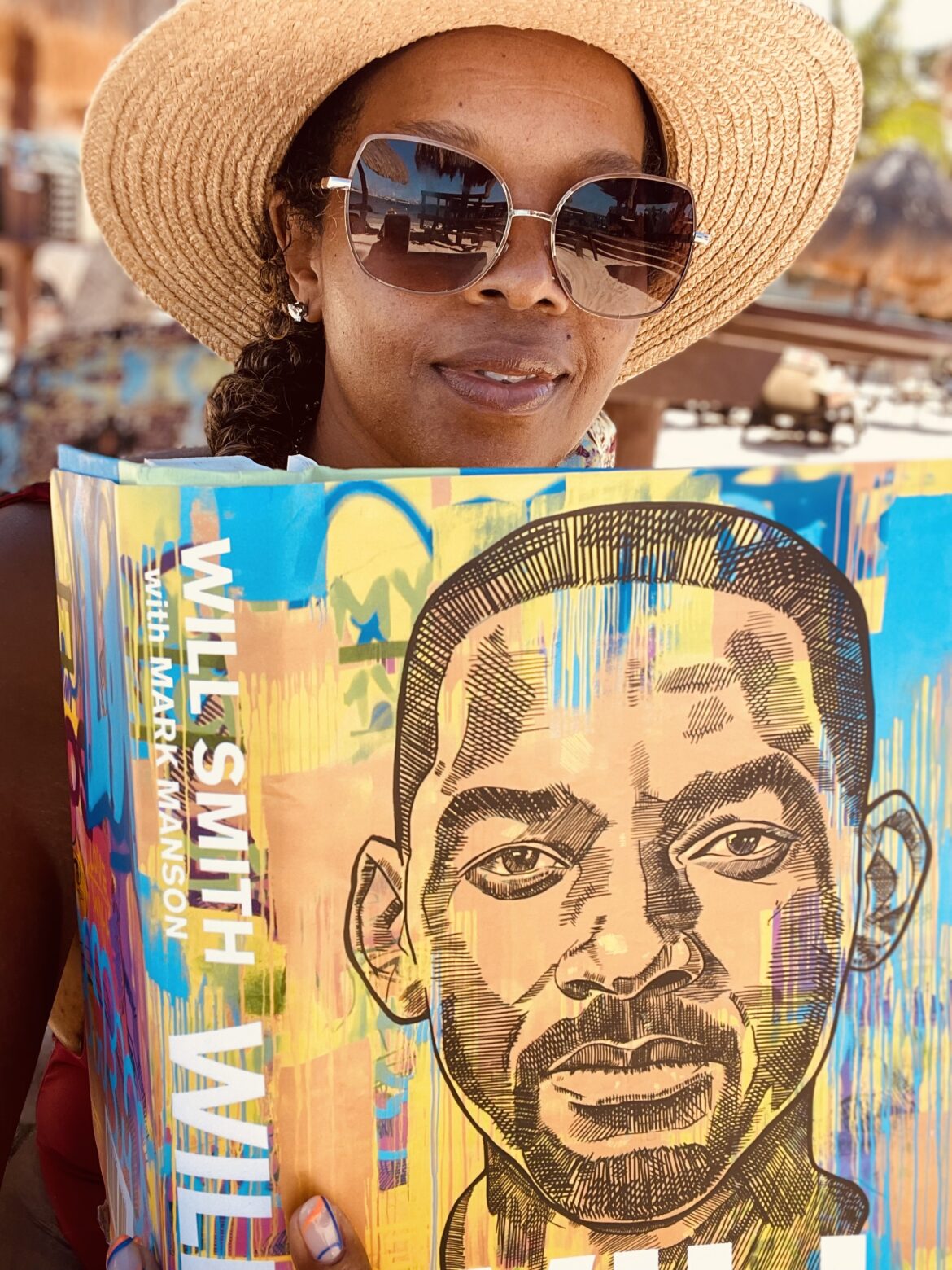

I recently connected with a nurse practitioner who had been following my blog. She was burned out, but she had a dream: to spend one month traveling abroad. Instead of walking away completely, she looked at her department’s calendar to see when things were least busy. Then she went to her boss and said:

“I’d like to take a month off. I’ll work extra shifts before and after, and I’ll use my vacation plus unpaid time if needed. I’ve supported my colleagues through their maternity leaves, and even though I don’t have children, I need this for my mental health.”

Her boss thought about it, came back a few days later, and approved it. She got the break she needed — without losing her job.

The takeaway? Sabbaticals don’t all look the same. Sometimes they mean quitting, like I did. Sometimes they mean negotiating extended time off. Both paths are valid. What matters most is giving yourself the permission to pause.

Myth 2: You Have to Be Rich to Take a Sabbatical

This one might be the most common. People assume sabbaticals are only for executives or influencers with endless money. But financial planning makes it possible.

When I first considered a sabbatical, my biggest fear was: How will I pay my bills? I pulled out an Excel sheet and calculated how much it would take to cover three months of living expenses including my condo, food, basics, and a little cushion. I also timed my exit to align with work bonuses and savings.

And guess what? The numbers worked.

You don’t have to be rich, but you do need a plan. For some, that means saving $500 a month for six months to cover one month off. For others, it means combining vacation days with unpaid leave to extend your time. I go deeper into this in How to Take a Sabbatical and Not Go Broke.

Rest is not only for the wealthy. With intention, it’s possible for you too.

Myth 3: A Sabbatical Has to Be Long and Luxurious

Yes, I believe three months is ideal. One month to decompress, one to explore or play, one to reflect and reimagine. But not everyone can carve out that much time right away.

That doesn’t mean you can’t start.

Think of “mini sabbaticals” as test runs. They can be a solo vacation, a local retreat, or even a week completely unplugged with no obligations.

When I traveled solo to Costa Rica for my birthday, I soaked in hot springs, journaled, and spent time with myself. It was only a week, but it felt like a reset and reminded me what was possible.

The difference between a vacation and a sabbatical isn’t location — it’s intention. A vacation gives you a break. A sabbatical gives you space to reflect and clarity for what’s next.

Myth 4: It’s Selfish to Step Away

I can’t tell you how many people asked me if I was okay when I announced I was leaving work. Some even told me not to call it a sabbatical — like rest needed to be justified.

Here’s the truth: taking a sabbatical isn’t selfish. It’s smart. It’s survival.

If we can take maternity leave, bereavement leave, or medical leave, why can’t we normalize taking time to care for our mental health and reset our lives? Burnout, compassion fatigue, and mental exhaustion are very real. Pretending we can just keep pushing isn’t sustainable — for our patients, our families, or ourselves.

You don’t owe anyone proof to deserve rest.

So How Do You Start?

The first step is clarity. Ask yourself:

- Why do I need this time?

- What would I want to do with one month off?

- How would I want to feel when I return?

If journaling isn’t your thing, open the notes app on your phone. Write a simple list. Be honest.

From there, look at what feels possible. Is it a week? A month? Three months? The length doesn’t matter as much as the intention.

Sabbaticals Are Possible for You Too

The biggest myth about sabbaticals is that they’re out of reach. That they’re for other people, not for you.

But my story, and the stories of others, prove otherwise. Sabbaticals don’t have to be about quitting, being rich, or flying across the world. They can be small, intentional pauses that give you rest, reflection, and a new vision for your life.

Because here’s the truth: you don’t need to blow up your life to take a sabbatical. But if you’re exhausted, uninspired, or longing for more, maybe a sabbatical, big or small, could change your life too.

Take care, take breaks.